News

Last week in energy prices - 12 February 2016

We’ve summarised the latest changes in the future energy markets to help inform your business energy strategy.

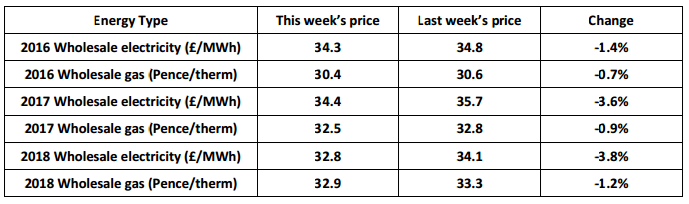

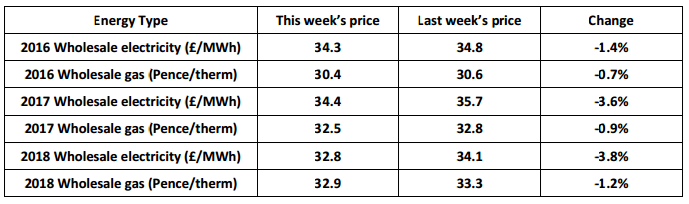

The table and graph below shows the forward annual gas (NBP) and electricity (base load) pricing.

Markets continued to cool in the first half of last week but bounced back on Thursday and Friday when the possibility of oil production cuts were again muted and oil traders began entering the market looking for a bargain.

Brent closed the week close to where it started at $33.50 per barrel and worries about China continue to weigh down global prices.

Markets continued to cool in the first half of last week but bounced back on Thursday and Friday when the possibility of oil production cuts were again muted and oil traders began entering the market looking for a bargain.

Brent closed the week close to where it started at $33.50 per barrel and worries about China continue to weigh down global prices.

Markets continued to cool in the first half of last week but bounced back on Thursday and Friday when the possibility of oil production cuts were again muted and oil traders began entering the market looking for a bargain.

Brent closed the week close to where it started at $33.50 per barrel and worries about China continue to weigh down global prices.

Markets continued to cool in the first half of last week but bounced back on Thursday and Friday when the possibility of oil production cuts were again muted and oil traders began entering the market looking for a bargain.

Brent closed the week close to where it started at $33.50 per barrel and worries about China continue to weigh down global prices.

UK Energy Market Report

UK prices tracked downwards in the first half of the week and rebounded on Friday with the start of the cold snap and an oil price recovery. The gas system coped well, in a state of oversupply for much of the week. 2016 contracts changed very little through the week but longer contracts showed small declines. News that Rugeley, a coal fired power station will be closing next summer, seemed to be offset by the announcement that Eggborough coal fired power station would stay now available for next winter when margins are tight. Yesterday, French producer EDF announced that it would extend the life of four nuclear power plants in the UK, which should further relieve fears about a looming power shortage. The within week prices remain volatile, but global economic concerns and oversupply of oil still offer attractive conditions for buyers. One trend to watch out for though, since mid-January prices (especially those attached to longer term contracts) seem to have traded within a nominal band with the oil price having temporarily steadied.Published by Utility Helpline on (modified )

Talk to us about how we can save you money