News

Weekly Energy Market Update 3/2/17

In terms of price drivers and market outlook, last week started quietly with little movement in energy complex pricing. As traders continued to wait out the full results of the OPEC production cuts, oil traded in a tight pattern with energy prices following suit. Much of the production cut has been neutralised by more US shale oil drilling and more increases in US storage. The value of the pound continued its rise early in the week as expectations of another US interest rate rise mounted. Later in the week, new sanctions in Iran caused the oil price to increase sharply and Brent closed the week up 2.3% at $58.61 a barrel.

In terms of price drivers and market outlook, last week started quietly with little movement in energy complex pricing. As traders continued to wait out the full results of the OPEC production cuts, oil traded in a tight pattern with energy prices following suit. Much of the production cut has been neutralised by more US shale oil drilling and more increases in US storage. The value of the pound continued its rise early in the week as expectations of another US interest rate rise mounted. Later in the week, new sanctions in Iran caused the oil price to increase sharply and Brent closed the week up 2.3% at $58.61 a barrel.

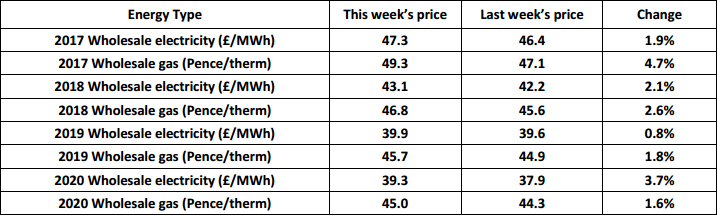

Energy prices in the UK

With oil prices providing little influence on the gas and electricity prices, the market traded on other fundamentals of supply and demand. The gas system started the week short, and with colder weather foretasted this month, short term prices increased. Although the system was long for most of the remainder of the week, gas prices climbed on weather forecasts and the sharp increases in oil. Electricity tracked coal prices, also rising on colder European temperatures and lower renewables output. Prices increased gradually over the course of the week. The main drivers were weather forecasts and the Iran sanctions. It is unclear whether the Iran sanctions will have long term consequences on the markets. Although clients may wait to see a firm market direction, risk averse energy buyers may want to stave off market volatility by securing a longer term contract today.

Published by Utility Helpline on (modified )

Talk to us about how we can save you money