News

Wholesale Energy Market Update 7/12/2018

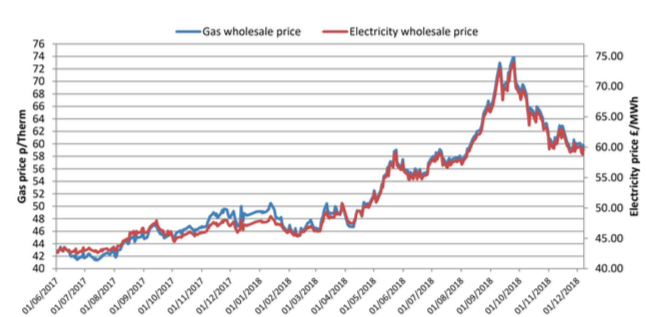

Last week, the markets saw a continuation of minimal overall movement whilst traders again tried to absorb events. There was an eventual OPEC agreement to cut output by 1.2 million barrels per day in the short term, after a tricky meeting that saw Iran secure an exemption and Russia and Saudi Arabia commit to reducing output - although, it remains to be seen whether this will be implemented.

A slight drop in temperatures across Europe, coupled with the deepening Brexit crisis, pushed prices up prices, despite supplies staying healthy. Brent finished up 5% at $61.67 per barrel.

Back home, despite a brief and unexpected Norwegian site outage, UK gas supplies remained healthy with continued high wind output and milder weather offsetting the Norwegian issues. There were continued regular LNG deliveries with ongoing low demand in Asia, who are also experiencing a mild start to winter. Sterling dropped once more amid Brexit concerns and this applied some pressure on prices. Electricity was more volatile, in response to the week's fluctuating wind output during the week and on the curve, tracking coal, carbon and gas.

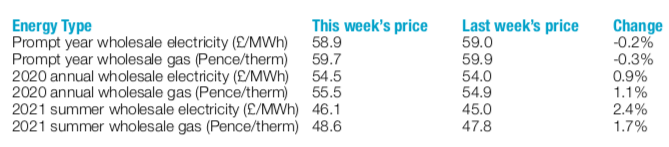

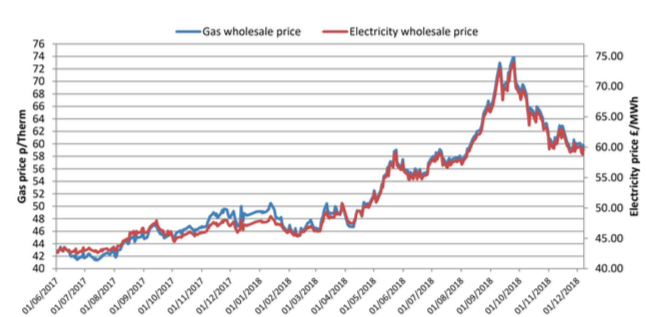

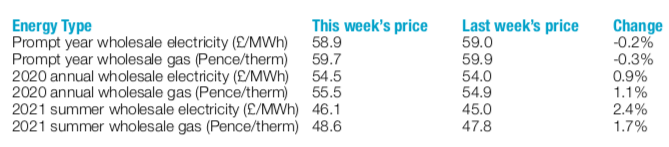

2019 contracts barely differed on the week while there were marginal increases on 2020 prices. There were some rises on 2020 summer prices, which was down to pressure on longer-term curves from rising oil.

A slight drop in temperatures across Europe, coupled with the deepening Brexit crisis, pushed prices up prices, despite supplies staying healthy. Brent finished up 5% at $61.67 per barrel.

Back home, despite a brief and unexpected Norwegian site outage, UK gas supplies remained healthy with continued high wind output and milder weather offsetting the Norwegian issues. There were continued regular LNG deliveries with ongoing low demand in Asia, who are also experiencing a mild start to winter. Sterling dropped once more amid Brexit concerns and this applied some pressure on prices. Electricity was more volatile, in response to the week's fluctuating wind output during the week and on the curve, tracking coal, carbon and gas.

2019 contracts barely differed on the week while there were marginal increases on 2020 prices. There were some rises on 2020 summer prices, which was down to pressure on longer-term curves from rising oil.

For the remaining, current winter, prices dropped steeply by up to 5% as the ongoing mild temperatures minimised risk. While the short term pricing has kept its volatility, longer term prices have stagnated. But, although the Brexit situation is in flux, the delayed vote, OPEC's decision and the reduced wind forecast, could all bring about further volatility. As ever, those with an appetite for risk should keep their eyes on the market, with likely periods of falling prices but much volatility coming with it.

For the remaining, current winter, prices dropped steeply by up to 5% as the ongoing mild temperatures minimised risk. While the short term pricing has kept its volatility, longer term prices have stagnated. But, although the Brexit situation is in flux, the delayed vote, OPEC's decision and the reduced wind forecast, could all bring about further volatility. As ever, those with an appetite for risk should keep their eyes on the market, with likely periods of falling prices but much volatility coming with it.

A slight drop in temperatures across Europe, coupled with the deepening Brexit crisis, pushed prices up prices, despite supplies staying healthy. Brent finished up 5% at $61.67 per barrel.

Back home, despite a brief and unexpected Norwegian site outage, UK gas supplies remained healthy with continued high wind output and milder weather offsetting the Norwegian issues. There were continued regular LNG deliveries with ongoing low demand in Asia, who are also experiencing a mild start to winter. Sterling dropped once more amid Brexit concerns and this applied some pressure on prices. Electricity was more volatile, in response to the week's fluctuating wind output during the week and on the curve, tracking coal, carbon and gas.

2019 contracts barely differed on the week while there were marginal increases on 2020 prices. There were some rises on 2020 summer prices, which was down to pressure on longer-term curves from rising oil.

A slight drop in temperatures across Europe, coupled with the deepening Brexit crisis, pushed prices up prices, despite supplies staying healthy. Brent finished up 5% at $61.67 per barrel.

Back home, despite a brief and unexpected Norwegian site outage, UK gas supplies remained healthy with continued high wind output and milder weather offsetting the Norwegian issues. There were continued regular LNG deliveries with ongoing low demand in Asia, who are also experiencing a mild start to winter. Sterling dropped once more amid Brexit concerns and this applied some pressure on prices. Electricity was more volatile, in response to the week's fluctuating wind output during the week and on the curve, tracking coal, carbon and gas.

2019 contracts barely differed on the week while there were marginal increases on 2020 prices. There were some rises on 2020 summer prices, which was down to pressure on longer-term curves from rising oil.

For the remaining, current winter, prices dropped steeply by up to 5% as the ongoing mild temperatures minimised risk. While the short term pricing has kept its volatility, longer term prices have stagnated. But, although the Brexit situation is in flux, the delayed vote, OPEC's decision and the reduced wind forecast, could all bring about further volatility. As ever, those with an appetite for risk should keep their eyes on the market, with likely periods of falling prices but much volatility coming with it.

For the remaining, current winter, prices dropped steeply by up to 5% as the ongoing mild temperatures minimised risk. While the short term pricing has kept its volatility, longer term prices have stagnated. But, although the Brexit situation is in flux, the delayed vote, OPEC's decision and the reduced wind forecast, could all bring about further volatility. As ever, those with an appetite for risk should keep their eyes on the market, with likely periods of falling prices but much volatility coming with it.Published by Utility Helpline on (modified )

Talk to us about how we can save you money