News

Wholesale energy prices update 10/03/17

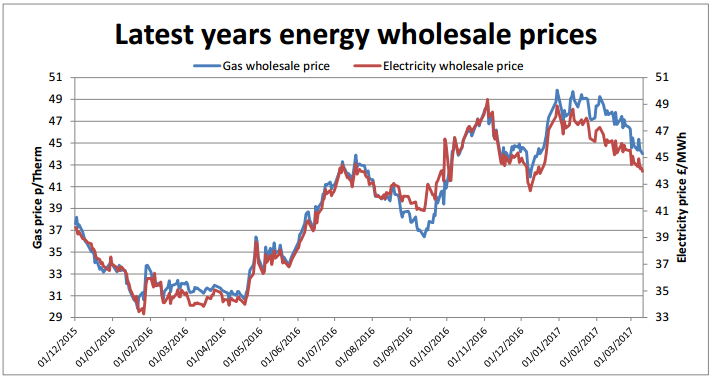

UK prices - Data shows forward annual gas and electricity prices in the wholesale market. Last week brought more slow change on the forward gas and electricity markets. Longer range weather forecasts for April predicted warmer across Europe and moved prices down slightly. And with the Dollar rallying strongly, most commodities became less attractive and fell. Oil prices also took a dive from last Wednesday when when news of a large rise of 8 million barrels in additional US storage broke. With US oil production back above 9 million barrels a week and new fracking wells being rapidly drilled, trader’s hopes that the OPEC cuts would reduce global supplies have been upset for now. With further falls late on Friday after European markets closed, Brent closed the week down a large 8% at $51.37 a barrel.  Unseasonably warm weather in the UK continued to drive energy prices down here. With the gas system well-supplied and multiple LNG deliveries arriving, more pressure came off gas and prices eased. Some of this drop was offset by higher demand from gas-fired power stations due to a lower generation wind generation. On the whole, most prices fell over the week. Shorter dated contracts fell as the probability of a cold end to the winter shortened. Falls in oil are also having an effect on prices helping to drown out any upward pressure. Risk averse energy buyers should still consider the possibility of further volatility. Buyers that are more comfortable with risk may want to see how the market plays out before they fix their energy prices.

Unseasonably warm weather in the UK continued to drive energy prices down here. With the gas system well-supplied and multiple LNG deliveries arriving, more pressure came off gas and prices eased. Some of this drop was offset by higher demand from gas-fired power stations due to a lower generation wind generation. On the whole, most prices fell over the week. Shorter dated contracts fell as the probability of a cold end to the winter shortened. Falls in oil are also having an effect on prices helping to drown out any upward pressure. Risk averse energy buyers should still consider the possibility of further volatility. Buyers that are more comfortable with risk may want to see how the market plays out before they fix their energy prices.

Published by Utility Helpline on (modified )

Talk to us about how we can save you money