News

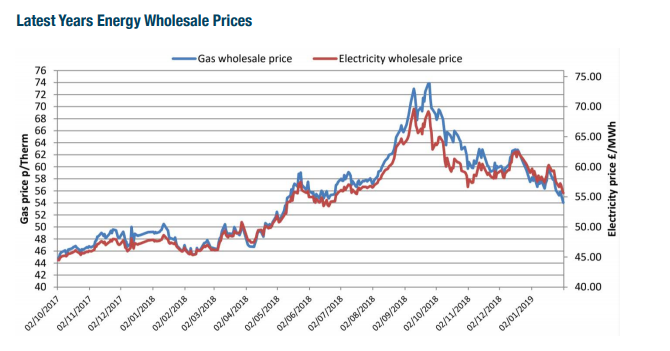

Wholesale Energy Prices Update 01/02/2019

Business energy markets pulled in different directions last week as the supply of gas held firm across Europe but oil prices increased.

A well-gas system in Europe put downward pressure on energy prices, but a perception of OPEC cuts and no end to the US-China trade dispute made market traders wary.

The political crisis in Venezuela is also compounding prices, with the US virtually banning oil imports from the country.

US oil output is still good, but not enough to balance out the market. Carbon prices also fell, but Brent closed the week up 4.7% at $62.75 a barrel.

In spite of the snow and the highest demands of the winter, the gas system was oversupplied for most of the week.

Availability was high from the North Sea, LNG and storage. LNG deliveries show no sign of dropping off and milder weather is forecast for the rest of the winter, reducing the risk of short-term price increases.

Business energy markets pulled in different directions last week as the supply of gas held firm across Europe but oil prices increased.

A well-gas system in Europe put downward pressure on energy prices, but a perception of OPEC cuts and no end to the US-China trade dispute made market traders wary.

The political crisis in Venezuela is also compounding prices, with the US virtually banning oil imports from the country.

US oil output is still good, but not enough to balance out the market. Carbon prices also fell, but Brent closed the week up 4.7% at $62.75 a barrel.

In spite of the snow and the highest demands of the winter, the gas system was oversupplied for most of the week.

Availability was high from the North Sea, LNG and storage. LNG deliveries show no sign of dropping off and milder weather is forecast for the rest of the winter, reducing the risk of short-term price increases.

| Energy Type Prompt year wholesale electricity (£/MWh) | This week’s price 55.6 | Last week’s price 57.5 | Change -3.3% |

| Prompt year wholesale gas (Pence/therm) | 54.1 | 56.1 | -3.6% |

| 2020 annual wholesale electricity (£/MWh) | 53.1 | 54.3 | -2.2% |

| 2020 annual wholesale gas (Pence/therm) | 53.5 | 53.7 | -0.4% |

| 2021 summer wholesale electricity (£/MWh) | 47.6 | 47.5 | 0.2% |

| 2021 summer wholesale gas (Pence/therm) | 47.7 | 47.4 | 0.6% |

Wind power generation was on the low side all week, but, overall, electricity supply was good and carbon prices fell across Europe. Contracts saw opposite movements last week. Short term pricing fell sharply, but longer contracts held their risk value. The promise of good weather has taken a lot of risk out of the wholesale energy system, but Brexit could still have a big impact on 2019 pricing. Longer term pricing was influenced by oil price increases Risk averse clients may still want to look at contracting to remove any Brexit risk but those willing to take some risk may well find that prices continue to descend if weather risk continues to diminish.

Published by Utility Helpline on

Talk to us about how we can save you money