News

Wholesale energy prices update 04/08/17

The first week of August brought some calm to the wholesale energy markets. Oil stagnated somewhat following large gains in the week previous. More falls in US storage levels were offset by continuing worries about rising production – particularly OPEC’s waning adherence to member production quotas. A slightly stronger pound helped keep prices under control as Brent closed the week practically unchanged at $52.33 a barrel.

The first week of August brought some calm to the wholesale energy markets. Oil stagnated somewhat following large gains in the week previous. More falls in US storage levels were offset by continuing worries about rising production – particularly OPEC’s waning adherence to member production quotas. A slightly stronger pound helped keep prices under control as Brent closed the week practically unchanged at $52.33 a barrel.

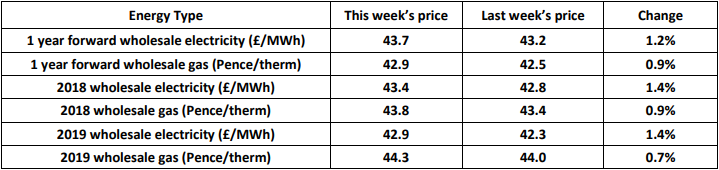

UK business energy prices

In the UK, prices rose and fell throughout the week. The gas system swung from long to short as Norwegian assets flicked off twice for unplanned outages. As renewable output dropped off slightly, power station demand for gas increased and cooler weather contributed to further system shortages. The unexpected news that Centrica has applied to release cushion gas from Rough storage by the start of winter had a tempering effect mid-week. Low renewable output early in the week and higher gas price saw electricity rise as well with higher coal price having a limited effect. All contracts saw small rises on the week although they were volatile. Prices have been gradually climbing since May with still no sign of any summer dip and with continuing supply problems. The release of cushion gas from Rough could mean that additional gas may be available this winter which may ease price pressure but with unknown supply margins, any substantial softening is not to be relied upon. Short term opportunities may still present themselves through the summer and early winter although with the October contract round, approaching, prices may rise so clients should monitor markets closely.

Published by Utility Helpline on (modified )

Talk to us about how we can save you money