News

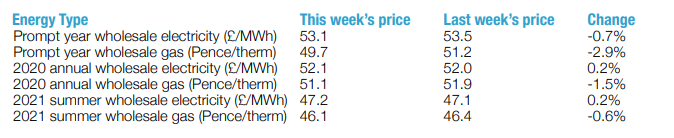

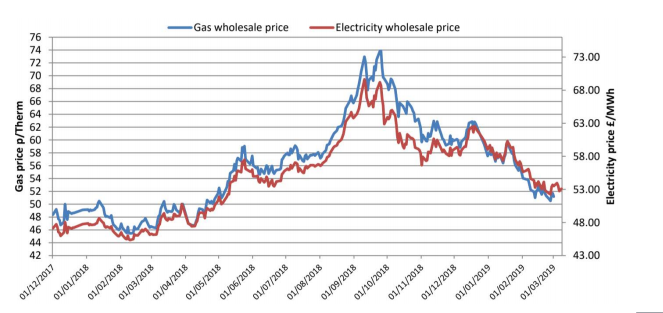

Wholesale Energy Prices Update 08/03/2019

Price pressure eased last week as, without seasonal norms, traders looked for any firm direction. Oil prices moved throughout the week but finished at about the same price as the start of the week as the rival forces of strong production and falling confidence in global demand remained in balance. European carbon prices stayed volatile throughout the week, with large swings in prices determined by auctions. The carbon price closed the week up 3%. The pound also jumped around a lot with the Brexit outlook shifting from day to day and hour to hour. Brent closed the week up 1% at $65.74 a barrel.

Price pressure eased last week as, without seasonal norms, traders looked for any firm direction. Oil prices moved throughout the week but finished at about the same price as the start of the week as the rival forces of strong production and falling confidence in global demand remained in balance. European carbon prices stayed volatile throughout the week, with large swings in prices determined by auctions. The carbon price closed the week up 3%. The pound also jumped around a lot with the Brexit outlook shifting from day to day and hour to hour. Brent closed the week up 1% at $65.74 a barrel.  In the UK, the gas system was well supplied. LNG supply was strong and made up for shortages from North Sea fields later in the week. Good wind output also reduced the demand for gas in power stations. With the price for oil and the value of the pound holding steady across the week and carbon seeing a small rise, pressure on short-and-long-term gas prices eased. Despite strong wind output and falling cold prices, electricity prices did suffer some upward pressure on news that the Dungeness B nuclear unit would have an extended maintenance period. All gas contracts fell last week. Short term prices saw the biggest falls as uncertainty and risk for the remainder of winter all but disappeared and carbon prices remained moderately steady. Electricity prices only fell slightly, or saw rises, as the news about Dungeness increased risk premiums. With a good deal of uncertainty still hanging over Brexit, risk-averse clients may wish to contract now to avoid any more potential volatility. But those that are willing and able to take on more risks may well find that the same volatility may offer opportunities in the short-term future.

In the UK, the gas system was well supplied. LNG supply was strong and made up for shortages from North Sea fields later in the week. Good wind output also reduced the demand for gas in power stations. With the price for oil and the value of the pound holding steady across the week and carbon seeing a small rise, pressure on short-and-long-term gas prices eased. Despite strong wind output and falling cold prices, electricity prices did suffer some upward pressure on news that the Dungeness B nuclear unit would have an extended maintenance period. All gas contracts fell last week. Short term prices saw the biggest falls as uncertainty and risk for the remainder of winter all but disappeared and carbon prices remained moderately steady. Electricity prices only fell slightly, or saw rises, as the news about Dungeness increased risk premiums. With a good deal of uncertainty still hanging over Brexit, risk-averse clients may wish to contract now to avoid any more potential volatility. But those that are willing and able to take on more risks may well find that the same volatility may offer opportunities in the short-term future.

Published by Utility Helpline on (modified )

Talk to us about how we can save you money