News

Wholesale Energy Prices Update 10/08/2018

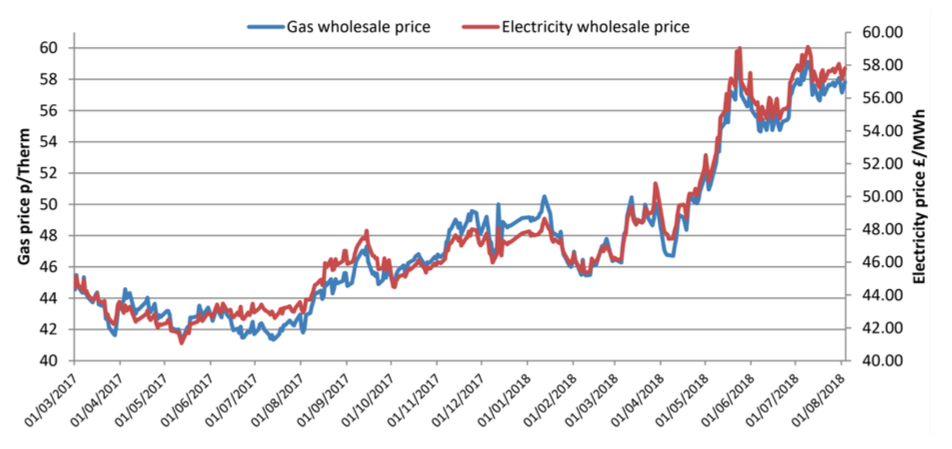

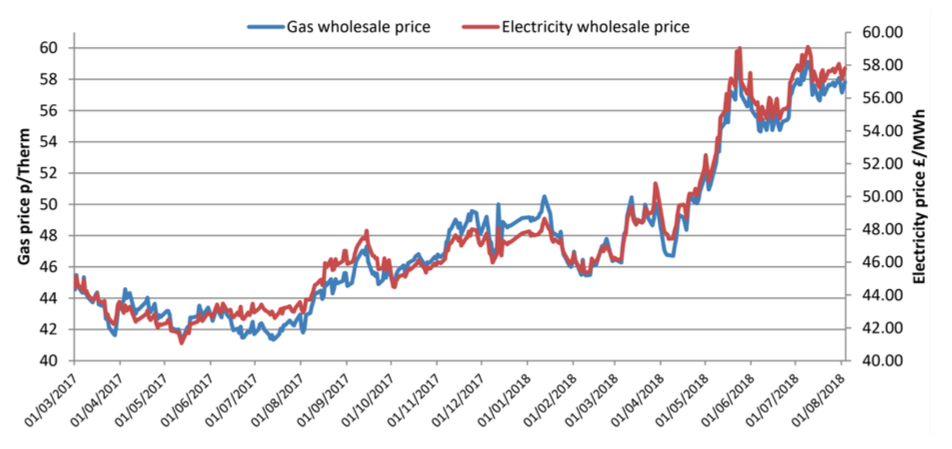

Energy prices were back on the rise last week despite some of the complex holding steady. The ongoing trade war between America and China meant oil prices continued searching for a direction, compounded by US storage volumes dropping further. Although Saudi Arabia and Russia boosted supply, there were still concerns that the new US sanctions on Iran and the resultant reduction in exports could spook the market.

In currencies, Sterling lost heavily against the Dollar and the Euro as a no deal Brexit becomes ever more likely. In response, prices were forced up due to many commodities being priced in the currencies. Brent finished down 1/2 % at $72.81 per barrel.

Here in the UK, North Sea assets (particularly Cygnus field) suffered unexpected outages which pushed prices up, despite the gas system being well-stocked. Wind generation stayed low with fluctuations which meant coal and gas power stations took on increased demand. This low wind output, couple with climbing gas prices. kept up the pressure on electricity prices. The aforementioned weak Sterling to Euro exchange put pressure on electricity bought via the Interconnector from across the Channel.

In currencies, Sterling lost heavily against the Dollar and the Euro as a no deal Brexit becomes ever more likely. In response, prices were forced up due to many commodities being priced in the currencies. Brent finished down 1/2 % at $72.81 per barrel.

Here in the UK, North Sea assets (particularly Cygnus field) suffered unexpected outages which pushed prices up, despite the gas system being well-stocked. Wind generation stayed low with fluctuations which meant coal and gas power stations took on increased demand. This low wind output, couple with climbing gas prices. kept up the pressure on electricity prices. The aforementioned weak Sterling to Euro exchange put pressure on electricity bought via the Interconnector from across the Channel.

There were large gains for contracts last week, owing to the continuing pressure on gas and electricity systems - even weathering the drop in oil. Both short and long term prices were boosted significantly over continuing concerns about Winter 18, allied with the longer term view for coal and oil risk. The Brexit related drop in the Pound has now become the dominant driver factor due to the euro / dollar priced commodity imports, meaning that prices will climb despite the commodity value remaining constant. These currency pressures could be crucial in the coming months - the post Brexit vote drop in Sterling was 10% and there are fears a similar drop could happen again if no deal is reached.

There were large gains for contracts last week, owing to the continuing pressure on gas and electricity systems - even weathering the drop in oil. Both short and long term prices were boosted significantly over continuing concerns about Winter 18, allied with the longer term view for coal and oil risk. The Brexit related drop in the Pound has now become the dominant driver factor due to the euro / dollar priced commodity imports, meaning that prices will climb despite the commodity value remaining constant. These currency pressures could be crucial in the coming months - the post Brexit vote drop in Sterling was 10% and there are fears a similar drop could happen again if no deal is reached.

In currencies, Sterling lost heavily against the Dollar and the Euro as a no deal Brexit becomes ever more likely. In response, prices were forced up due to many commodities being priced in the currencies. Brent finished down 1/2 % at $72.81 per barrel.

Here in the UK, North Sea assets (particularly Cygnus field) suffered unexpected outages which pushed prices up, despite the gas system being well-stocked. Wind generation stayed low with fluctuations which meant coal and gas power stations took on increased demand. This low wind output, couple with climbing gas prices. kept up the pressure on electricity prices. The aforementioned weak Sterling to Euro exchange put pressure on electricity bought via the Interconnector from across the Channel.

In currencies, Sterling lost heavily against the Dollar and the Euro as a no deal Brexit becomes ever more likely. In response, prices were forced up due to many commodities being priced in the currencies. Brent finished down 1/2 % at $72.81 per barrel.

Here in the UK, North Sea assets (particularly Cygnus field) suffered unexpected outages which pushed prices up, despite the gas system being well-stocked. Wind generation stayed low with fluctuations which meant coal and gas power stations took on increased demand. This low wind output, couple with climbing gas prices. kept up the pressure on electricity prices. The aforementioned weak Sterling to Euro exchange put pressure on electricity bought via the Interconnector from across the Channel.

There were large gains for contracts last week, owing to the continuing pressure on gas and electricity systems - even weathering the drop in oil. Both short and long term prices were boosted significantly over continuing concerns about Winter 18, allied with the longer term view for coal and oil risk. The Brexit related drop in the Pound has now become the dominant driver factor due to the euro / dollar priced commodity imports, meaning that prices will climb despite the commodity value remaining constant. These currency pressures could be crucial in the coming months - the post Brexit vote drop in Sterling was 10% and there are fears a similar drop could happen again if no deal is reached.

There were large gains for contracts last week, owing to the continuing pressure on gas and electricity systems - even weathering the drop in oil. Both short and long term prices were boosted significantly over continuing concerns about Winter 18, allied with the longer term view for coal and oil risk. The Brexit related drop in the Pound has now become the dominant driver factor due to the euro / dollar priced commodity imports, meaning that prices will climb despite the commodity value remaining constant. These currency pressures could be crucial in the coming months - the post Brexit vote drop in Sterling was 10% and there are fears a similar drop could happen again if no deal is reached.Published by Utility Helpline on (modified )

Talk to us about how we can save you money