News

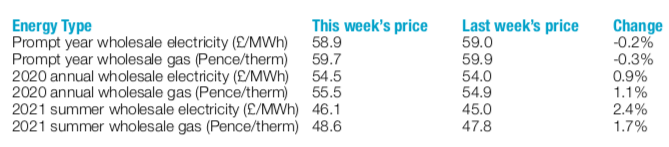

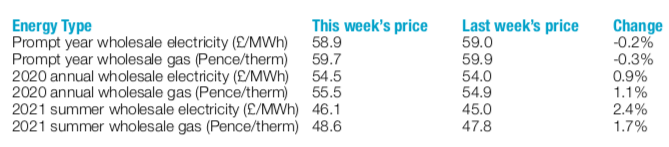

Wholesale Energy Prices Update 11/1/2019

It was a week of mixed fortunes in the markets. It became evident that indeed OPEC had cut supplies, with Saudi Arabia and Russia slashing their exports, and in response oil bounced back significantly. Better news re the China-US trade stand-off added to this rebound, although it was tempered by ongoing general concerns over a global economic slowdown. The colder weather arrived in Europe but supplies coped well. Brent finished at $60.48 a barrel, 5.5% up on the week.

Back in the UK, the gas system coped well, despite the forecast of colder weather. There were continued deliveries from Norway and LNG with the only potential problem coming from a brief North Sea outage at the beginning of the week. There were no major issues and electricity continued to track gas, with a drop in wind and partial recovery for carbon from its recent losses.

Back in the UK, the gas system coped well, despite the forecast of colder weather. There were continued deliveries from Norway and LNG with the only potential problem coming from a brief North Sea outage at the beginning of the week. There were no major issues and electricity continued to track gas, with a drop in wind and partial recovery for carbon from its recent losses.

Further out, there were slight increases on curve prices, due to rising oil and carbon. Prices for the rest of the winter dropped, however, due to the milder weather. Keep an eye out on this week's Brexit vote as it is bound to have some impact on the market, especially with the likely currency movements. There will, of course, still be weather-related factors to take into account.

If there was to be a turn in the weather, prices could well rise, so those looking to minimise risk should avoid waiting on the forecasts, or indeed any significant Brexit developments. However, those with more of an appetite for risk could benefit from holding out to see if a satisfactory deal is reached.

Further out, there were slight increases on curve prices, due to rising oil and carbon. Prices for the rest of the winter dropped, however, due to the milder weather. Keep an eye out on this week's Brexit vote as it is bound to have some impact on the market, especially with the likely currency movements. There will, of course, still be weather-related factors to take into account.

If there was to be a turn in the weather, prices could well rise, so those looking to minimise risk should avoid waiting on the forecasts, or indeed any significant Brexit developments. However, those with more of an appetite for risk could benefit from holding out to see if a satisfactory deal is reached.

Back in the UK, the gas system coped well, despite the forecast of colder weather. There were continued deliveries from Norway and LNG with the only potential problem coming from a brief North Sea outage at the beginning of the week. There were no major issues and electricity continued to track gas, with a drop in wind and partial recovery for carbon from its recent losses.

Back in the UK, the gas system coped well, despite the forecast of colder weather. There were continued deliveries from Norway and LNG with the only potential problem coming from a brief North Sea outage at the beginning of the week. There were no major issues and electricity continued to track gas, with a drop in wind and partial recovery for carbon from its recent losses.

Contrasting fortunes for energy contracts

There was a mixed week for contracts. There were falls for the front year but price rises for further out. The absence of wintry weather forecasted, and healthy gas storage levels, meant that additional risk premium was removed from the short term prices. Further out, there were slight increases on curve prices, due to rising oil and carbon. Prices for the rest of the winter dropped, however, due to the milder weather. Keep an eye out on this week's Brexit vote as it is bound to have some impact on the market, especially with the likely currency movements. There will, of course, still be weather-related factors to take into account.

If there was to be a turn in the weather, prices could well rise, so those looking to minimise risk should avoid waiting on the forecasts, or indeed any significant Brexit developments. However, those with more of an appetite for risk could benefit from holding out to see if a satisfactory deal is reached.

Further out, there were slight increases on curve prices, due to rising oil and carbon. Prices for the rest of the winter dropped, however, due to the milder weather. Keep an eye out on this week's Brexit vote as it is bound to have some impact on the market, especially with the likely currency movements. There will, of course, still be weather-related factors to take into account.

If there was to be a turn in the weather, prices could well rise, so those looking to minimise risk should avoid waiting on the forecasts, or indeed any significant Brexit developments. However, those with more of an appetite for risk could benefit from holding out to see if a satisfactory deal is reached.Published by Utility Helpline on

Talk to us about how we can save you money