News

Wholesale energy prices update 15/12/17

Last week brought more violent price swings to an already volatile marketplace. The market for wholesale gas and electricity was driven by several major events. The week started quietly enough before a crack was discovered in the Forties pipeline in the North Sea, removing up to 40% of North Sea output for around two weeks. This short-term impact on prices was exacerbated by a temporary power cut and shut down at the Troll field – the largest gas and oil field in the Norwegian section of the North Sea. On Tuesday, tragically, an explosion at the Baumgarten gas transit site in Austria killed one person and injured 21 others. The site, which handles 10% of all the Russian gas passing into Europe, was shut down and oil, gas and electricity spiked massively as short-term wholesale prices rose by up to 30%. Oil prices began to recede towards the end of the week as the Austrian gateway reopened and fundamental market patterns like increasing US supply began to lead the market. Brent eventually closed the week almost unchanged at $63.23 a barrel.

Last week brought more violent price swings to an already volatile marketplace. The market for wholesale gas and electricity was driven by several major events. The week started quietly enough before a crack was discovered in the Forties pipeline in the North Sea, removing up to 40% of North Sea output for around two weeks. This short-term impact on prices was exacerbated by a temporary power cut and shut down at the Troll field – the largest gas and oil field in the Norwegian section of the North Sea. On Tuesday, tragically, an explosion at the Baumgarten gas transit site in Austria killed one person and injured 21 others. The site, which handles 10% of all the Russian gas passing into Europe, was shut down and oil, gas and electricity spiked massively as short-term wholesale prices rose by up to 30%. Oil prices began to recede towards the end of the week as the Austrian gateway reopened and fundamental market patterns like increasing US supply began to lead the market. Brent eventually closed the week almost unchanged at $63.23 a barrel.

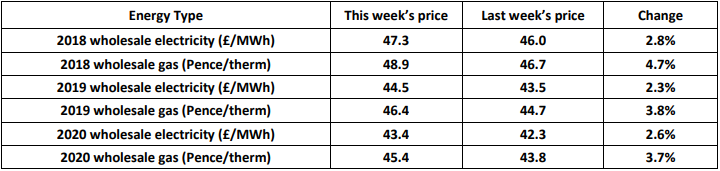

In the UK market, cold weather pushed demand up at the same time as supply started to wane. But the gas system coped well with the unexpected shutdowns. Warmer forecasts for next week took some of the sting out of price rises, but risk premiums remain high. Electricity prices followed gas despite healthy renewables output. Fixed price contracts saw large gains on the week, with prompt year and gas seeing big gains. Short term contracts for Q1 2018 (January to March) saw some of the biggest rises, up as much as 6% on short-term risk. Forecasts for the rest of December are mild, so that may bring some relief. But prices are likely to stay high while the risk from the North Sea events is present. The renewable output is still healthy, so electricity prices will be less affected than gas prices, but there should still be some gains. Clients with February or March renewals may well see higher prices now but should continue to monitor markets closely and be ready to contract during any falls.

Published by Utility Helpline on (modified )

Talk to us about how we can save you money