News

Wholesale energy prices update 31/03/17

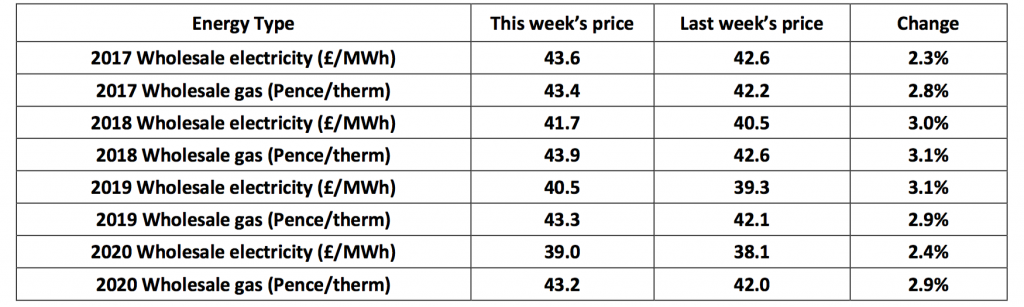

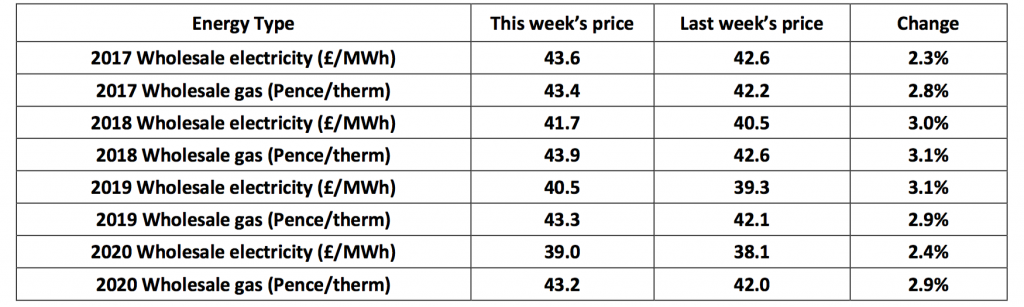

UK prices - Data shows forward annual gas and electricity prices in the wholesale market.

Prices fluctuated throughout a vibrant week on the markets. Kicking off with warmer weather forecasts for Europe, Euro coal prices stabilised and oil continued to track down. There was a mid-week blip as oil prices rose in response to cooler weather forecasts from Wednesday, also boosting coal prices. Simultaneously the Pound fell once Article 50 was triggered.

Oil’s mini revival was driven by the sudden drop in Libyan production when a transfer main went offline. Additionally, OPEC met to extend their cuts for longer than the proposed 6 months and there were signs that storage growth in the USE is stalling. The week closed with Brent up by 6% at $55.53 a barrel.

Prices fluctuated throughout a vibrant week on the markets. Kicking off with warmer weather forecasts for Europe, Euro coal prices stabilised and oil continued to track down. There was a mid-week blip as oil prices rose in response to cooler weather forecasts from Wednesday, also boosting coal prices. Simultaneously the Pound fell once Article 50 was triggered.

Oil’s mini revival was driven by the sudden drop in Libyan production when a transfer main went offline. Additionally, OPEC met to extend their cuts for longer than the proposed 6 months and there were signs that storage growth in the USE is stalling. The week closed with Brent up by 6% at $55.53 a barrel.

Prices fluctuated throughout a vibrant week on the markets. Kicking off with warmer weather forecasts for Europe, Euro coal prices stabilised and oil continued to track down. There was a mid-week blip as oil prices rose in response to cooler weather forecasts from Wednesday, also boosting coal prices. Simultaneously the Pound fell once Article 50 was triggered.

Oil’s mini revival was driven by the sudden drop in Libyan production when a transfer main went offline. Additionally, OPEC met to extend their cuts for longer than the proposed 6 months and there were signs that storage growth in the USE is stalling. The week closed with Brent up by 6% at $55.53 a barrel.

Prices fluctuated throughout a vibrant week on the markets. Kicking off with warmer weather forecasts for Europe, Euro coal prices stabilised and oil continued to track down. There was a mid-week blip as oil prices rose in response to cooler weather forecasts from Wednesday, also boosting coal prices. Simultaneously the Pound fell once Article 50 was triggered.

Oil’s mini revival was driven by the sudden drop in Libyan production when a transfer main went offline. Additionally, OPEC met to extend their cuts for longer than the proposed 6 months and there were signs that storage growth in the USE is stalling. The week closed with Brent up by 6% at $55.53 a barrel.

UK energy market

The falling Pound contributed to the the UK gas system starting long but shortening by mid-week and prices increased despite a slight drop in demand. Further pressure came from traders needing to close out final positions ready for the summer 2017 contracts starting. Oil, coal and gas all moved upwards, however prices eased on Friday. Electricity kept pace with gas and coal with a healthy renewable output throughout the week. There was a significant rebound in the markets last week with all contracts increasing by 2 or 3%. There was a certain amount of market volatility as traders fulfilled their requirements in the last trading week for Summer 17 which meant a profit for sellers.

Outlook

With the rebound in oil prices, May’s OPEC meeting is looking like it will be vital to forward pricing, with agreement on whether or not production cuts will continue beyond the initial six months. Those who are risk-averse should consider their contracts now whilst prices are still low. The current market volatility looks likely to continue so those clients comfortable with the inherent trading risk should monitor the markets carefully in preparation for any price fluctuation.Published by Utility Helpline on (modified )

Talk to us about how we can save you money