News

Wholesale Energy Prices Update 06/07/2018

Energy prices took something of a breather last week as markets digested the magnitude of recent events. Oil prices fell down slightly as President Trump, Saudi Arabia and Russia tried to talk prices down. Despite a previous announcement of increased supplies, markets continued to worry about shortages from the re-instated US sanctions on Iran, troubles in Libya and freefalling production in Venezuela. Figures that showed around 500,000 barrels a day were produced in Saudi in June and a surprise increase in US storage levels on Thursday helped calm things to a degree, but prices remain volatile. Brent closed the week down 2.9% at $77.11 a barrel.

Energy prices took something of a breather last week as markets digested the magnitude of recent events. Oil prices fell down slightly as President Trump, Saudi Arabia and Russia tried to talk prices down. Despite a previous announcement of increased supplies, markets continued to worry about shortages from the re-instated US sanctions on Iran, troubles in Libya and freefalling production in Venezuela. Figures that showed around 500,000 barrels a day were produced in Saudi in June and a surprise increase in US storage levels on Thursday helped calm things to a degree, but prices remain volatile. Brent closed the week down 2.9% at $77.11 a barrel.

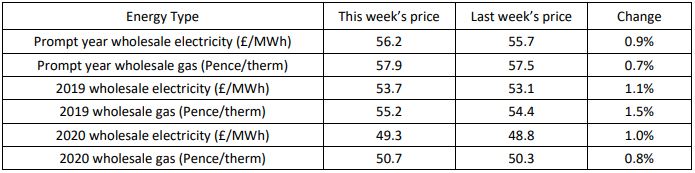

Outages continued in the North Sea, keeping the pressure on prices in the UK. Injections into European storage saw demand kept high as levels are still below their three-year average. Impending annual maintenance on the Yamal and Nordstream pipelines from Russia is contributing to this price pressure. As is low wind output, which has kept demand for gas up in power stations. Electricity prices also suffered under low wind output, but high solar output during the recent heatwave offset some of this effect. All contracts saw moderate increases last week as gas demand pressures pushed prices up, despite slight drops in the price of oil. Shorter-term prices are still under pressure with August prices pushed up due to European demand and winter 2018 holding onto risk premium due to supply uncertainties. Two and three-year contracts remain cheaper than one-year deals due to this risk factor. Time is starting to run out to see the more normal dip in prices during summer. Especially given the oil market turmoil, but those clients who have time may still wish to wait and see how this market develops before making longer-term decisions.

Published by Utility Helpline on (modified )

Talk to us about how we can save you money